Illinois revocable living trust form.

Revocable living trust illinois form.

Unlike a will which takes effect upon a person s death when an individual uses this kind of estate planning it goes into effect during their lifetime.

To put it simply when you create a revocable living trust you still have a form of control in being able to change or terminate the trust therefore it is.

Illinois has a simplified probate process for small estates under 100 000 excluding real estate.

In its simplest form a trust is the desig nation of a person or corporation to act as.

How do i choose between a revocable living trust and an irrevocable living trust.

Illinois state bar association.

What is a trust.

Some illinois residents choose to plan their estates and get their affairs in order using revocable living trusts.

The answers to these questions will give you a general overview of the advantag es and disadvantages of using a living trust as your primary estate planning document.

Living trusts if i have a living trust do i still need a will accessed march 16 2020.

Illinois revocable living trust form the illinois revocable living trust is an entity into which a person places their assets to save the inheritors the long and costly probate process in illinois.

In its simplest form a trust is the designation of a person or corporation to act as a trustee to deal with the trust property and administer that property in accordance with the instructions in the trust document.

The revocable liv ing trust.

How do i put money and other assets in a living trust accessed march 16 2020.

Illinois does not use the uniform probate code which simplifies the probate process so it may be a good idea for you to make a living trust to avoid illinois s complex probate process.

A living trust also called a revocable trust or an inter vivos trust goes into effect during your lifetime and is.

Superior court of california.

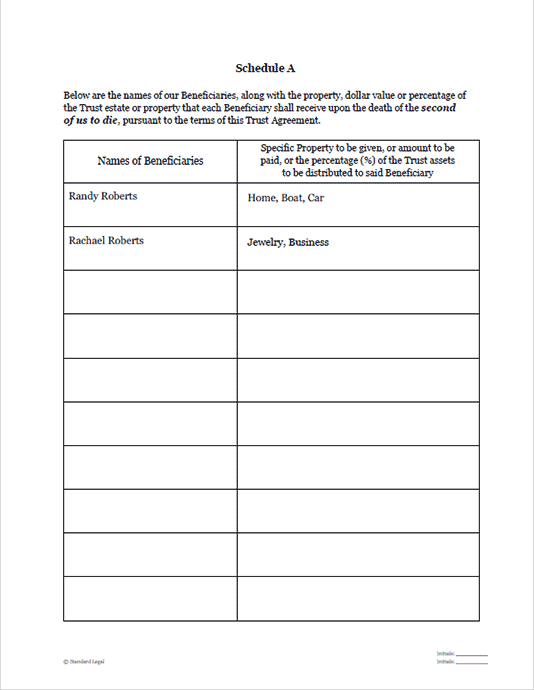

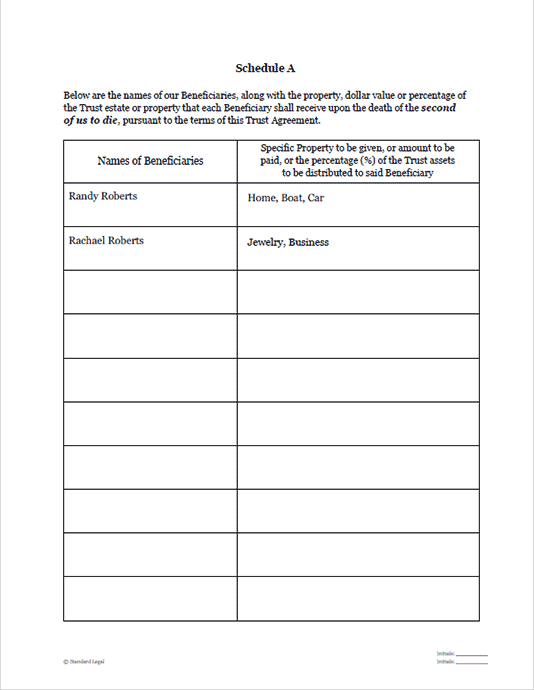

Download this illinois revocable living trust form in order to set aside assets and property for your loved ones with the flexibility of dictating the terms of how and when the adobe pdf.

Aside from avoiding probate the grantor person who establishes the trust has continued access to their assets if they become incapacitated in any.

Your guide to a living trust how are assets distributed at your death accessed march 16 2020.

The initial creator of the trust referred to as the grantor will transfer property and assets to the.

A living trust is a trust established during a person s lifetime in which a person s assets and property are placed within the trust usually for the purpose of estate planning.